UK gambling tax applies to casino operators, who are required to pay 2.5-40% of their gross gaming revenue. The United Kingdom has a wide variety of casinos, with around 24 in London, 13 in Scotland and 5 in Wales. Gambling Income Tax Requirements for Nonresidents. Nonresidents can usually report income that is 'effectively connected' with a U.S. Business on Form 1040NR-EZ. Gambling winnings, however, are considered to be 'not effectively connected' and must generally be reported on Form 1040NR. Such income is generally taxed at a flat rate of 30%. This qualified them for a more beneficial capital gains tax rate of 24%, or just 10% if they invested in AIM shares. However, April 2008 brought with it change. Gone was tapered relief and in its place, a fixed 18% capital gains tax rate was introduced. This gives the majority of investors a substantial tax advantage over traders.

Online betting companies based in offshore havens to sidestep Britain's gambling taxes will be hit with a new levy that may raise £300m for the taxpayer.

The Government is to impose a 15% tax rate on operators in the £2bn remote gambling market.

The rules state that from December 2014 gambling must be taxed according to where customers are based rather than where the online operator is registered.

'It is unacceptable that gambling companies can avoid UK taxes by moving offshore, and the Government is taking decisive action to ensure this can no longer happen,' Economic Secretary to the Treasury Sajid Javid said.

'These reforms will ensure that remote gambling operators who have UK customers make a fair contribution to the public finances.'

The shift will affect some of the industry's largest players.

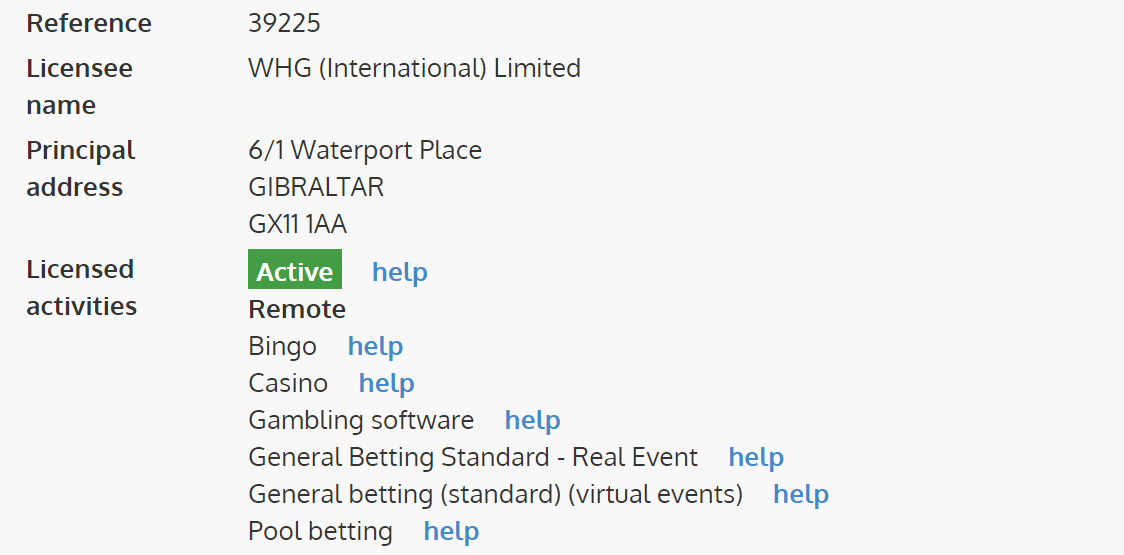

Ladbrokes, Bwin.party, William Hill and Betfair all have online operations based in Gibraltar, where taxes are levied at 1% and capped at £425,000.

More from Business

The proposed 15% rate, which the Government said will be confirmed in its Budget statement next March, would mean that offshore operators are taxed at the same level as domestic internet betting companies.

Officials estimates that the new rules will bring in £300m a year in additional tax revenue.

Plans to bring offshore gaming companies under the UK tax system were outlined in the 2012 Budget, but the industry had been waiting for the detail - most crucially the rate at which they will be taxed.

Uk Casino Tax Rate 2019

William Hill, which has the largest share of the UK's remote gambling market, has previously suggested that it could challenge the changes on the grounds that they breach European Union competition law.

Uk Casino Tax Rate 2018

The Gambling Commission said that the estimated worldwide remote gross gambling yield (GGY) - excluding telephone betting - was £21.08bn during 2012, up 5% on the previous year.

It said the UK consumer GGY generated with operators regulated overseas, which includes telephone betting, is estimated to have grown approximately 1% between 2011 and 2012.

The commission said remote GGY for operators licensed in Great Britain accounts for approximately 4% of the global total.